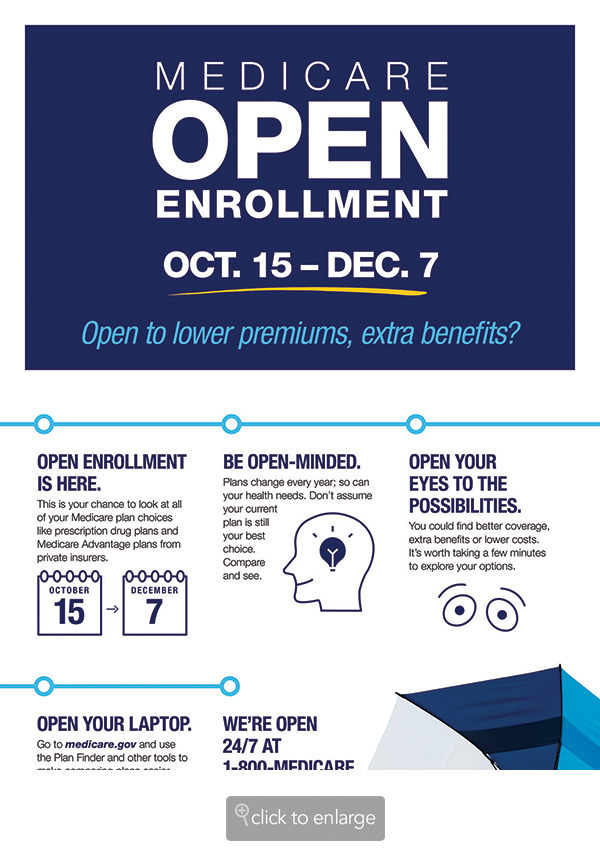

(Family Features) Each year between Oct. 15 and Dec. 7 people can make changes to their Medicare coverage options.

Medicare’s annual Open Enrollment period started on Oct. 15 and ends on Dec. 7. This is the one time of the year for you to review your current coverage and decide if there are better coverage options based on changes to the current plans, your budget, and your health needs.

During Medicare Open Enrollment, you can keep your current plan or review the options in your area to join a different prescription drug plan or Medicare Advantage plan. The Open Enrollment period gives everyone with Medicare the opportunity to make changes to their Medicare health plans or prescription drug plans for coverage beginning Jan. 1, 2019.

Think about what matters most to you and be open to different options, like Medicare Advantage plans from private insurers. Medicare Advantage plans allows you to simplify your coverage by combining all of your Medicare health and drug coverage into a single plan.

People who choose Medicare Advantage plans are often able to lower their out-of-pocket costs while getting extra benefits, like vision, hearing, dental, and prescription drug coverage. New this year, some Medicare Advantage plans are offering supplemental benefits that can include adult day care services, in-home support services, caregiver support services, home-based palliative care, and therapeutic massage. Best of all, prices are going down. The average Medicare Advantage monthly premium will decrease to $28 for 2019.

Medicare health and drug plans change each year, and so can your health needs. Think about your health status and determine if you need to make a change by asking yourself these questions:

- Does my current plan cover my medications?

- Does another plan offer the same coverage at a lower cost?

- Am I interested in having a plan that covers extra benefits like dental and vision?

- Does the network include the specialist or hospital I want for an upcoming surgery?

Get Started on Medicare.gov

Medicare.gov has new tools that can help you review your options.

If you have questions about what type of coverage is right for you, the following tools may help:

- Compare Coverage Options Tool: Asks five simple questions to see if Original Medicare or a Medicare Advantage Plan meets your needs.

- Estimate Medicare Costs Tool: Helps you estimate out-of-pocket costs depending on the Medicare coverage you choose.

- Plan Finder Tool: Lets you compare plans to see the exact costs for plans in your area based on the prescription drugs you take and the pharmacy you use. If you are open to coverage choices, you may find a plan that costs less, covers your drugs, and offers extra benefits like vision and dental coverage. Try the web chat feature for real-time help.

Once you’ve chosen a plan, check its Star Rating before you enroll. The Plan Finder Tool gives you up-to-date Star Ratings for Medicare health and prescription drug plans. You can use Star Ratings to compare the quality of health and drug plans being offered.

Medicare Open Enrollment ends on Dec. 7. Now is the time to act if you want to enroll in or make changes to your Medicare health or prescription drug plan for coverage beginning Jan. 1, 2019. If your current coverage still meets your needs, then you don’t have to do anything. However, if you miss the Dec. 7 Open Enrollment deadline, you will likely have to wait a full year before you are able to make changes to your Medicare coverage.

For more information, visit Medicare.gov or call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048. Help is available 24 hours a day, including weekends. If you need help in a language other than English or Spanish, let the customer service representative know the language.

Help in your community is also available. You can get personalized health insurance counseling at no cost to you from your State Health Insurance Assistance Program (SHIP). Visit shiptacenter.org or call 1-800-MEDICARE for your SHIP’s phone number.

More information about Medicare is also available on the Medicare Facebook page and by following @MedicareGov on Twitter.

Get Help Paying for Prescriptions

Anyone who has Medicare can get prescription drug coverage. Some people with limited resources and income may also be able to get Extra Help to pay for monthly premiums, annual deductibles, and prescription co-payments related to a Medicare prescription drug plan. If you have limited income and resources, you may qualify for Extra Help to pay for some health care and prescription drug costs.

Medicare estimates more than 2 million people with Medicare may be eligible for Extra Help but aren’t currently enrolled in the program. To qualify, your annual income must be less than $18,210 a year ($24,690 for married couples). Even if your annual income is higher, you may still qualify. Your resources must also be limited to $14,100 ($28,100 for married couples). Resources include bank accounts, stocks, and bonds, but not your house, car, or life insurance policies.

Protect Your Medicare Card

Protect your identity as well as your health by guarding your Medicare card like you would a credit card. To help aid in the fight against identity theft resulting from stolen Medicare numbers, Medicare removed Social Security Numbers from cards and replaced them with new, unique numbers for each person with Medicare. New Medicare cards started mailing in April 2018. The new Medicare card will not change any of the program benefits and services that eligible people enrolled in Medicare receive. Here are some steps you can take to protect yourself from identity theft:

- Don’t share your Medicare number or other personal information with anyone who contacts you by telephone, email, or approaches you in person, unless you’ve given them permission in advance.

- Medicare will never contact you (unless you ask them to) for your Medicare number or other personal information.

- Remember that the new Medicare card does not cost you anything.

- Don’t ever let anyone borrow or pay to use your Medicare number.

- Review your Medicare summary notices to be sure you and Medicare are only being charged for actual services provided.

- Be wary of salespeople who knock on your door or call you uninvited and try to sell you a product or service.

- Don’t accept items received through the mail that you didn’t order. You should refuse the delivery or return it to the sender. Keep a record of the sender’s name and the date you returned the items.

- If someone calls you and asks for your Medicare number or other personal information, hang up and call 1-800-MEDICARE (1-800-633-4227), and learn more at Medicare.gov/fraud.

To see if you qualify, apply online at secure.ssa.gov/i1020/start or call 1-800-772-1213.